How to claim income tax relief on Revenue.ie

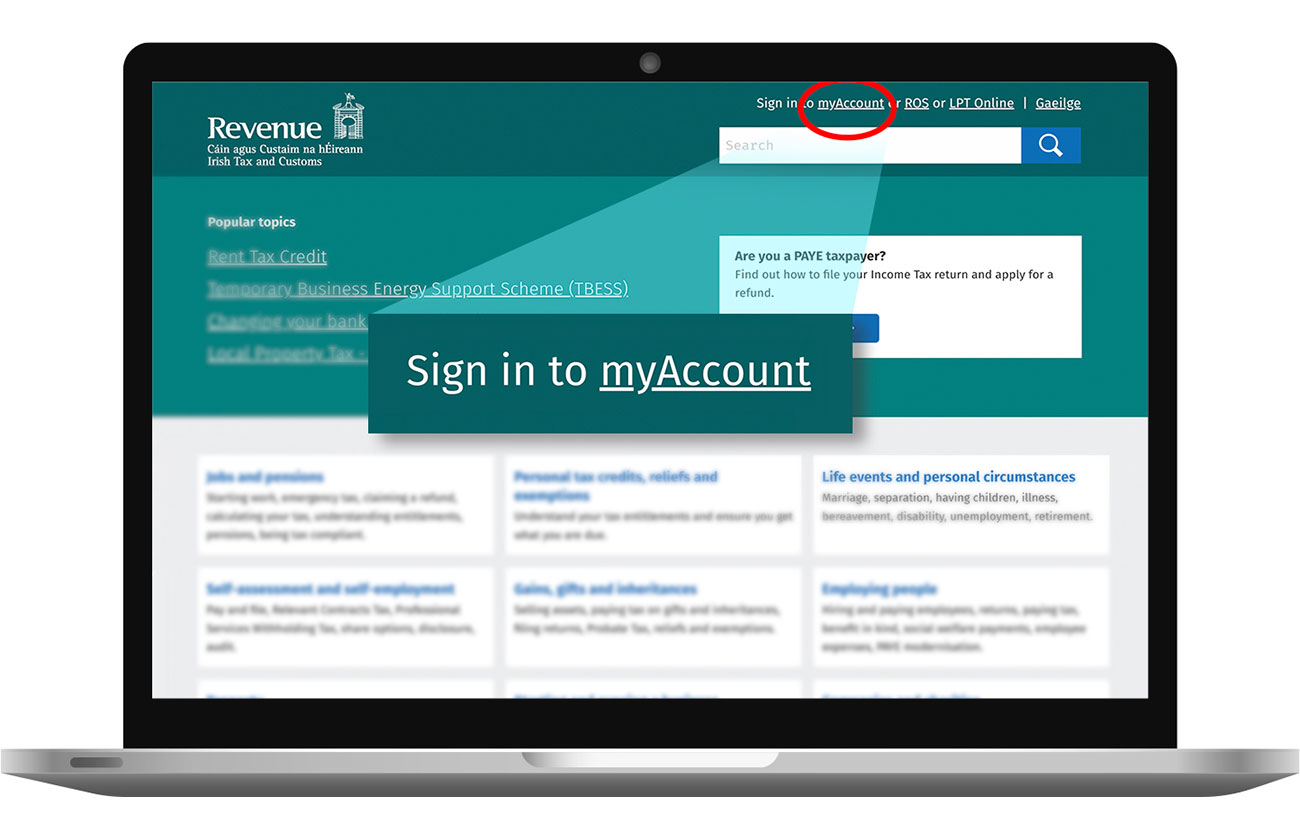

Step 1: Revenue Homepage

Revenue website. https://www.revenue.ie

To start, click “My account” at the top right hand corner of the page.

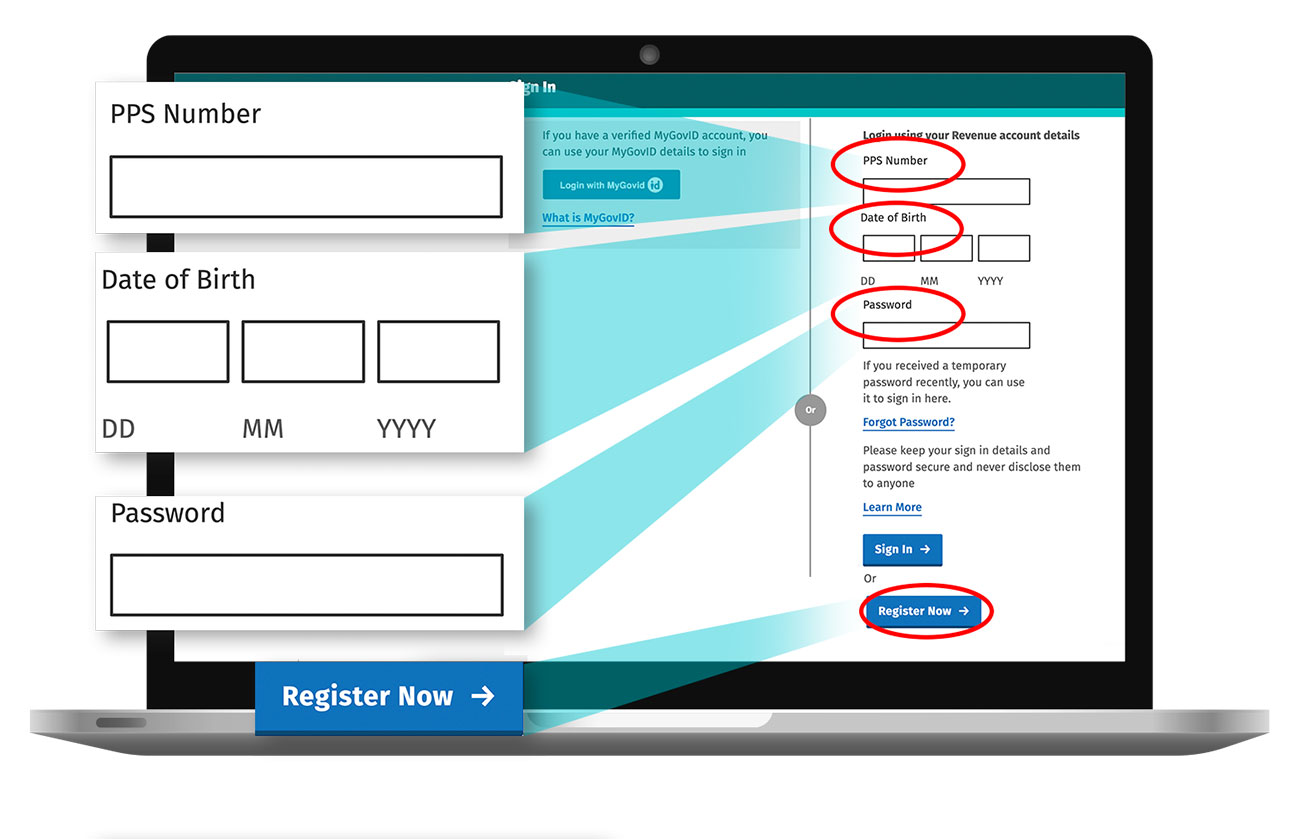

Step 2: Sign In

- This will bring you to the Sign In page.

- If you have not yet registered on “My Account”, select “Register Now” and follow the instructions.

- Once registered, submit your PPS number, Date of Birth and Password to sign in.

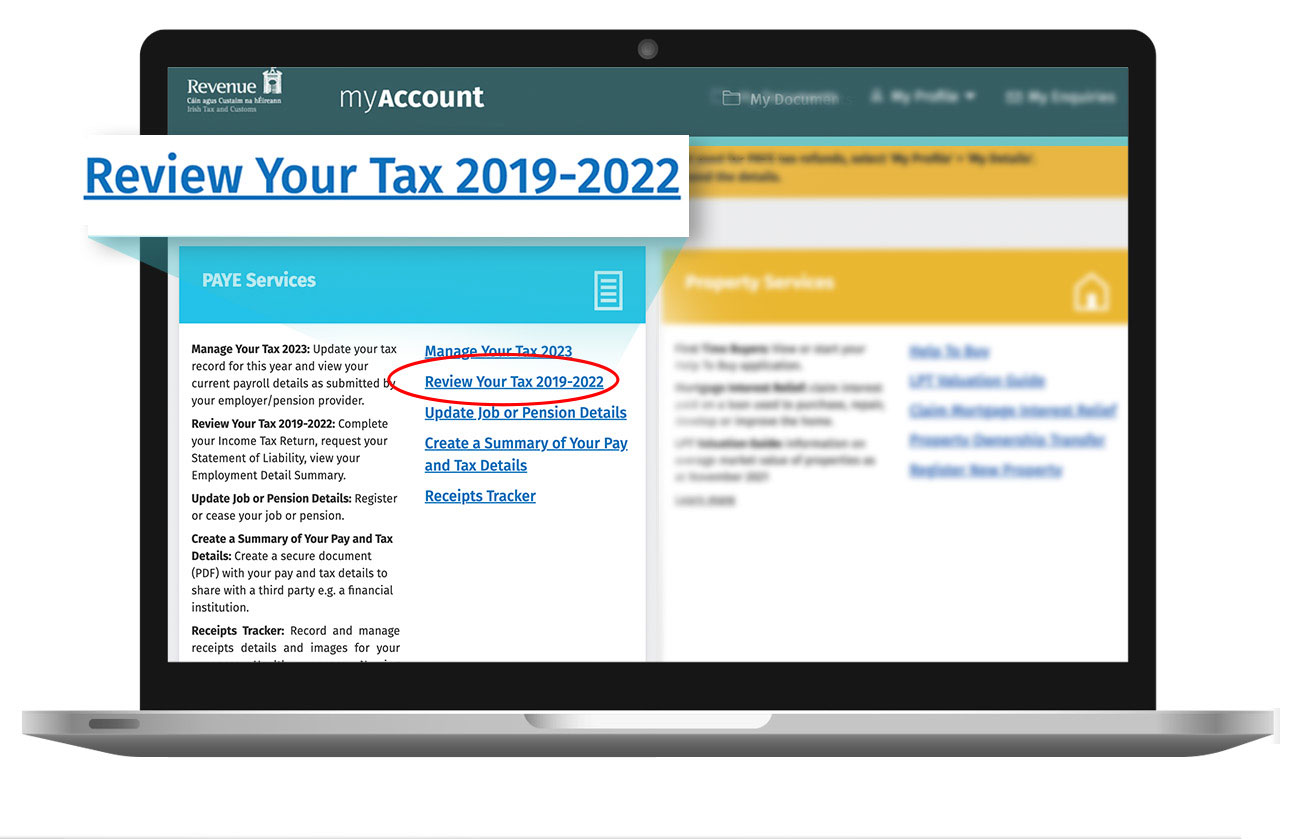

Step 3: Home Screen

- Once you have signed in, you will be brought to the home screen.

- Select “Review Your Tax 2018-2021” link under PAYE Services.

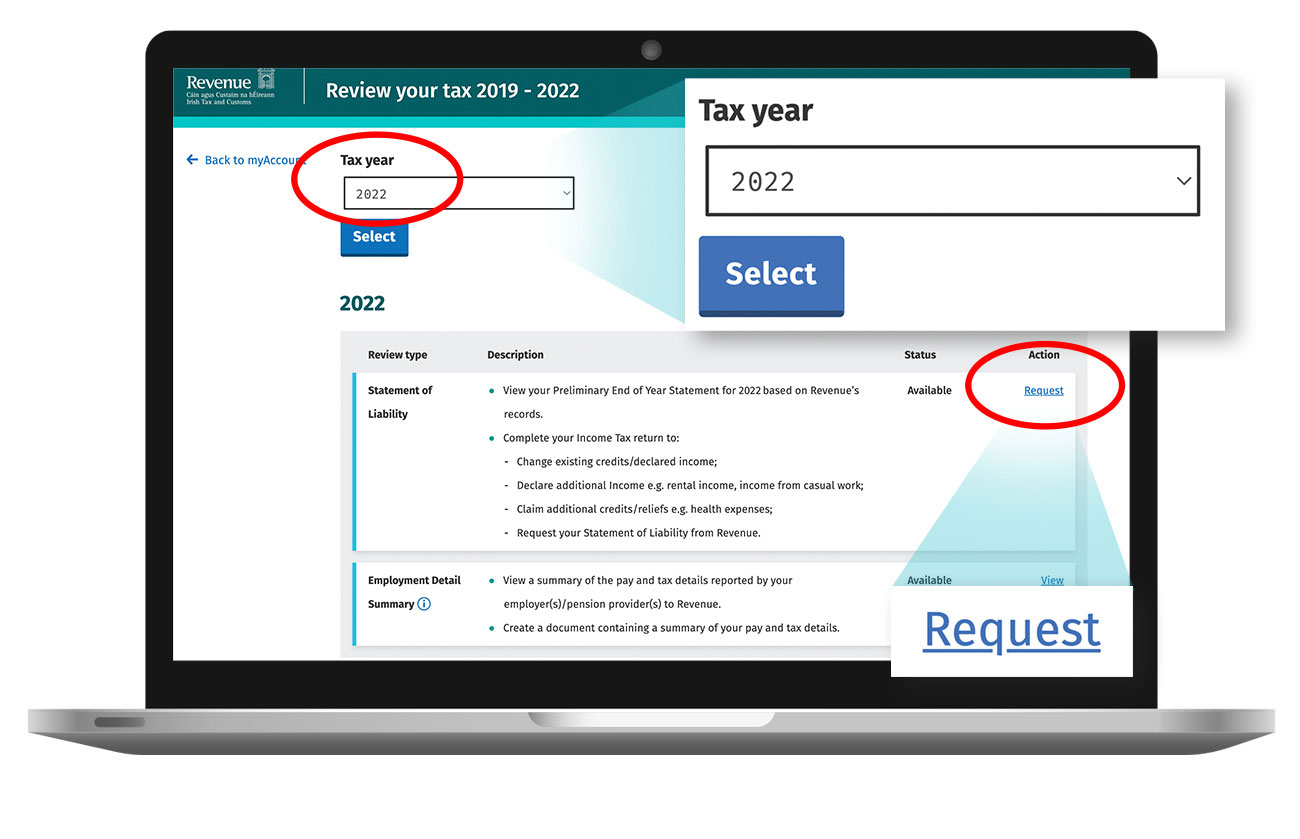

Step 4: Statement of Liability

- From here, you can choose your tax year for which you wish to generate the Statement of Liability, using the dropdown functionality.

- In the section titled “Statement of Liability”, click “Request”.

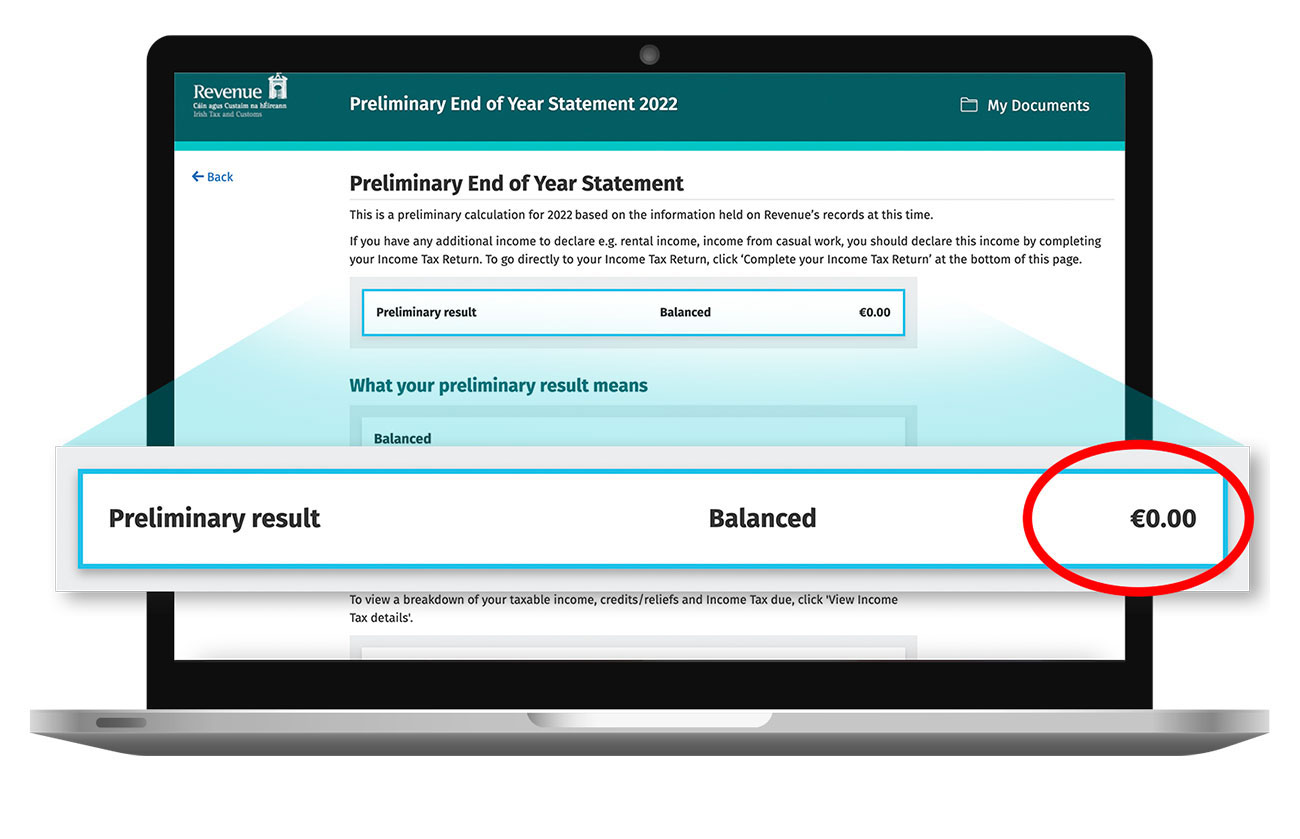

Step 5: Preliminary End of Year Statement

- From here, you will see a page with a breakdown of your tax payments from your chosen year.

- It is recommended that your tax calculation has gone through before you proceed so that you can see whether there I an overpayment or underpayment of tax.

- In this instance, the employee has a Nil balance

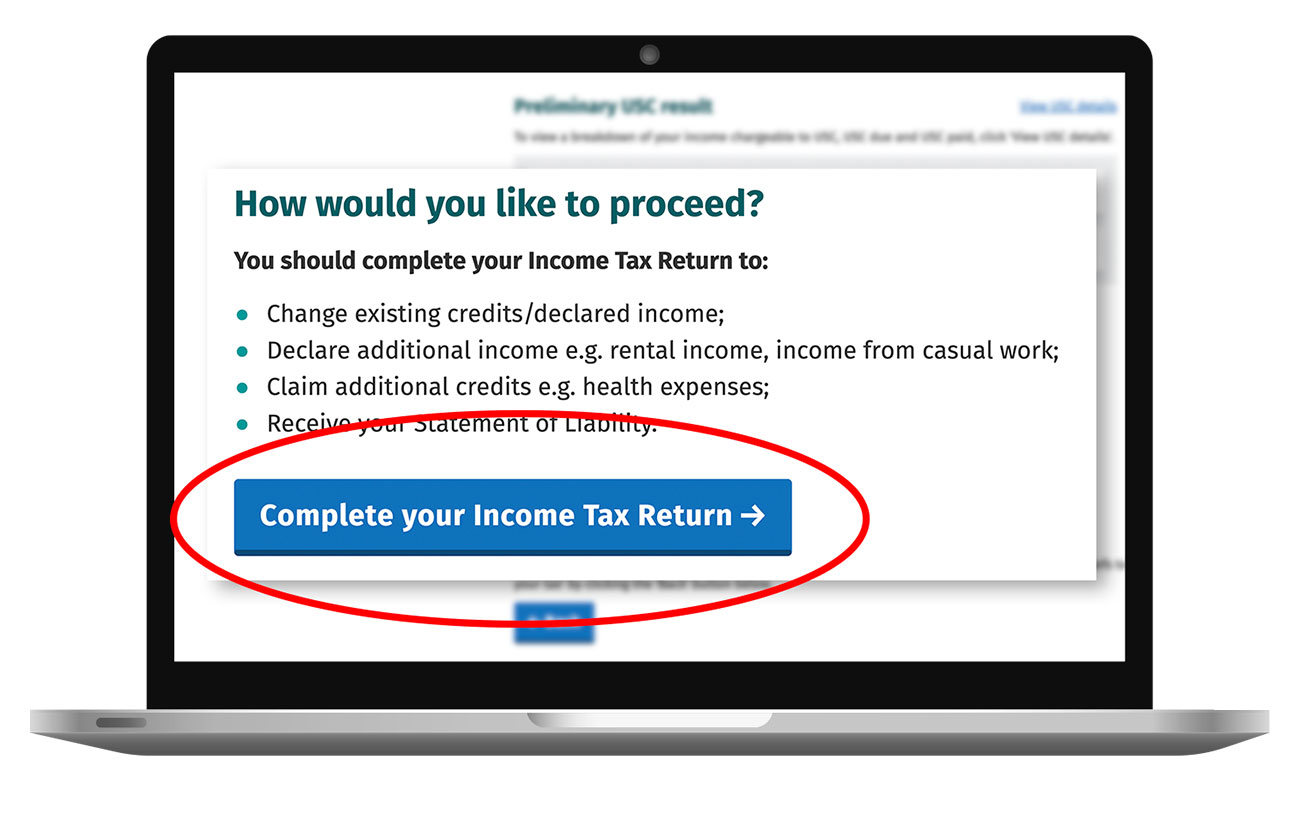

Step 6: Income Tax Return

- Scroll down to the bottom on that same page and click “Complete Your Income Tax Return”

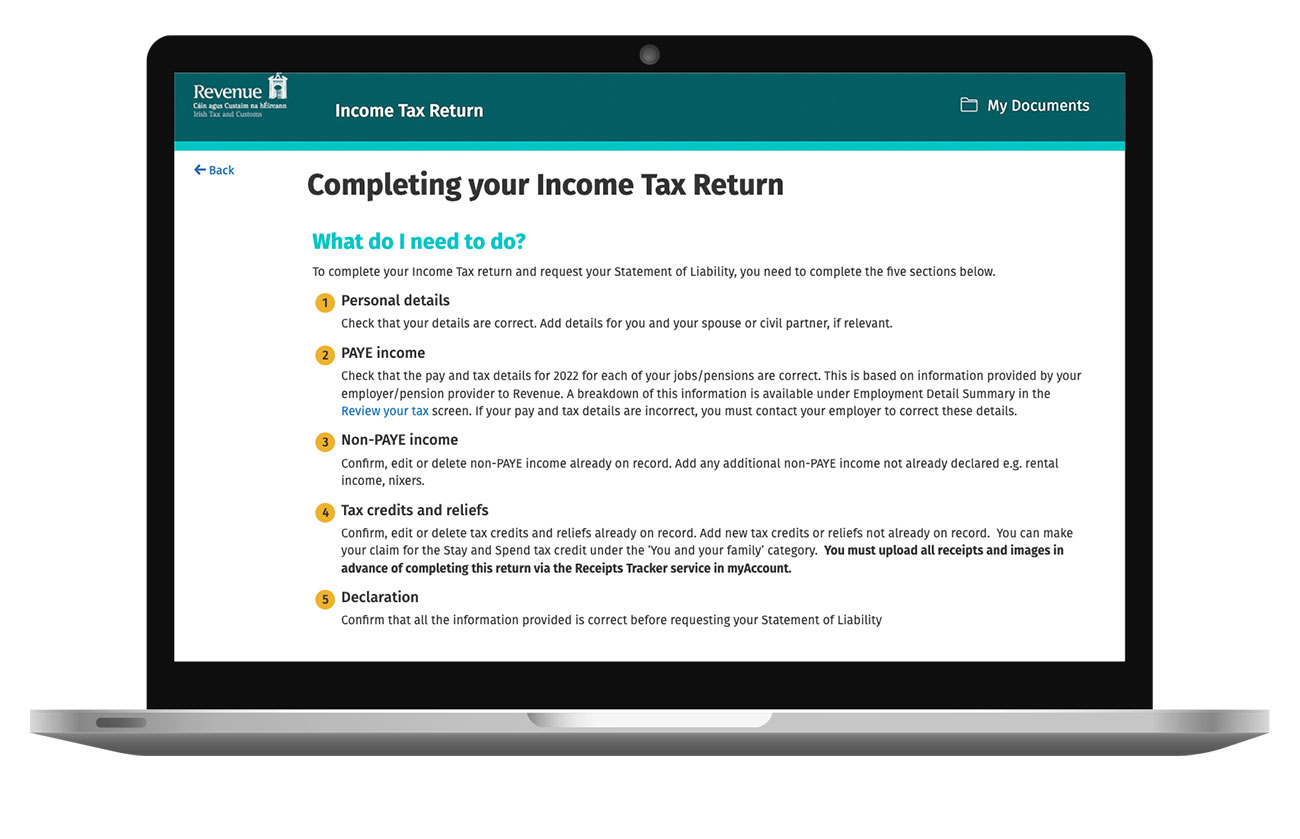

Step 7: What do I need to do?

- You will then be brought to a page detailing the five steps needed to complete your Income Tax Return.

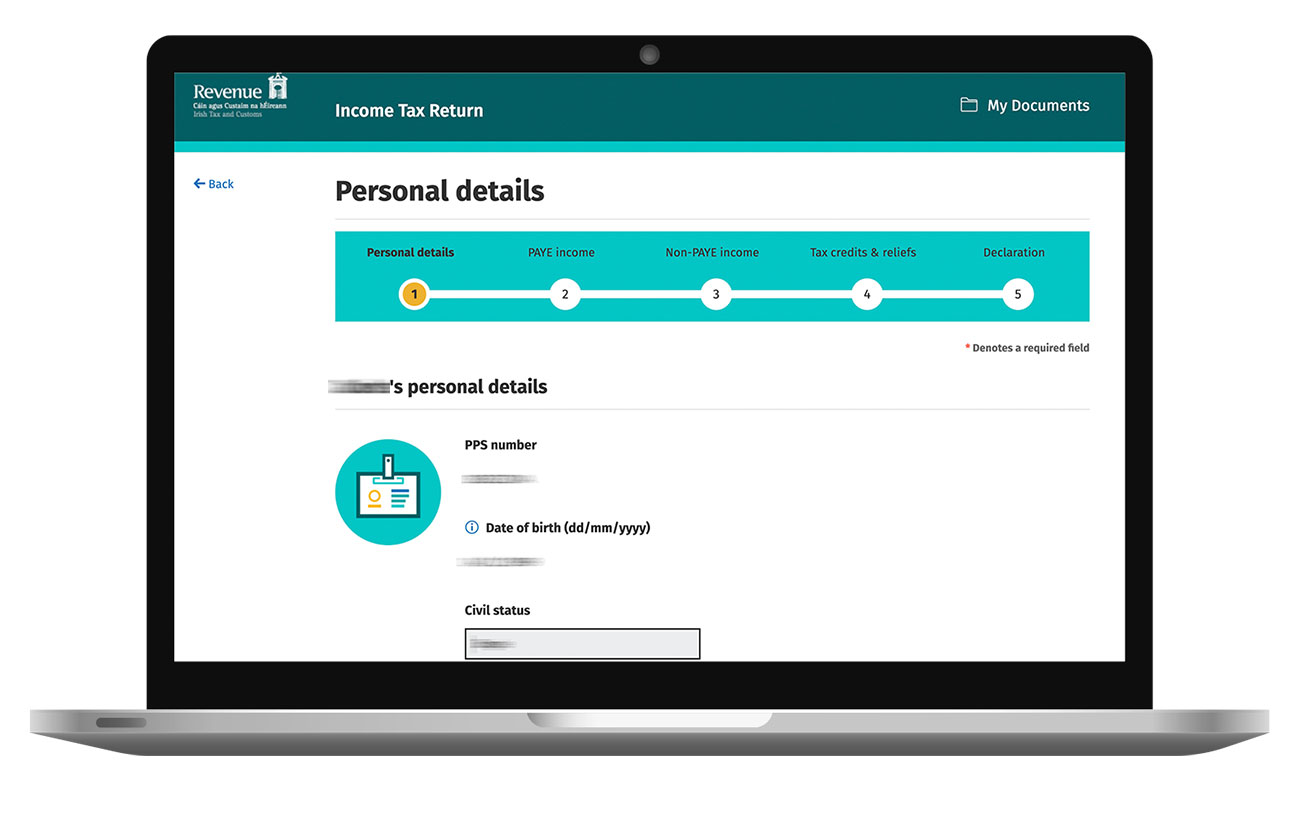

Step 8: Personal Details

To start, review and edit (if necessary) Personal Details:

PPS number

Date of Birth

Civil Status

Residency

Contact details

Bank account details

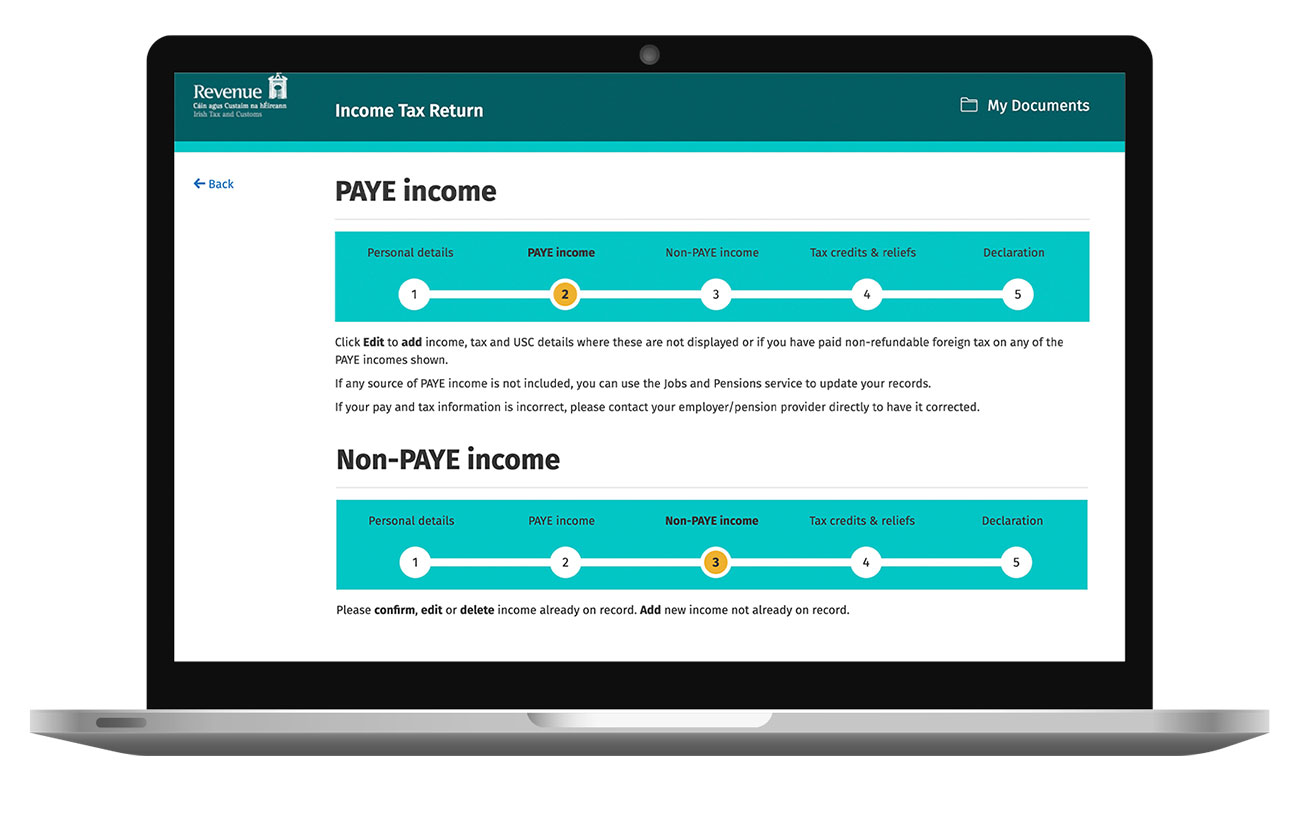

Step 9: PAYE & Non PAYE

- You can choose to add income, tax and USC details for PAYE and non-PAYE income which are not already recorded by Revenue here.

- Once you have checked your PAYE income and any non-PAYE income is recorded, click “Next”.

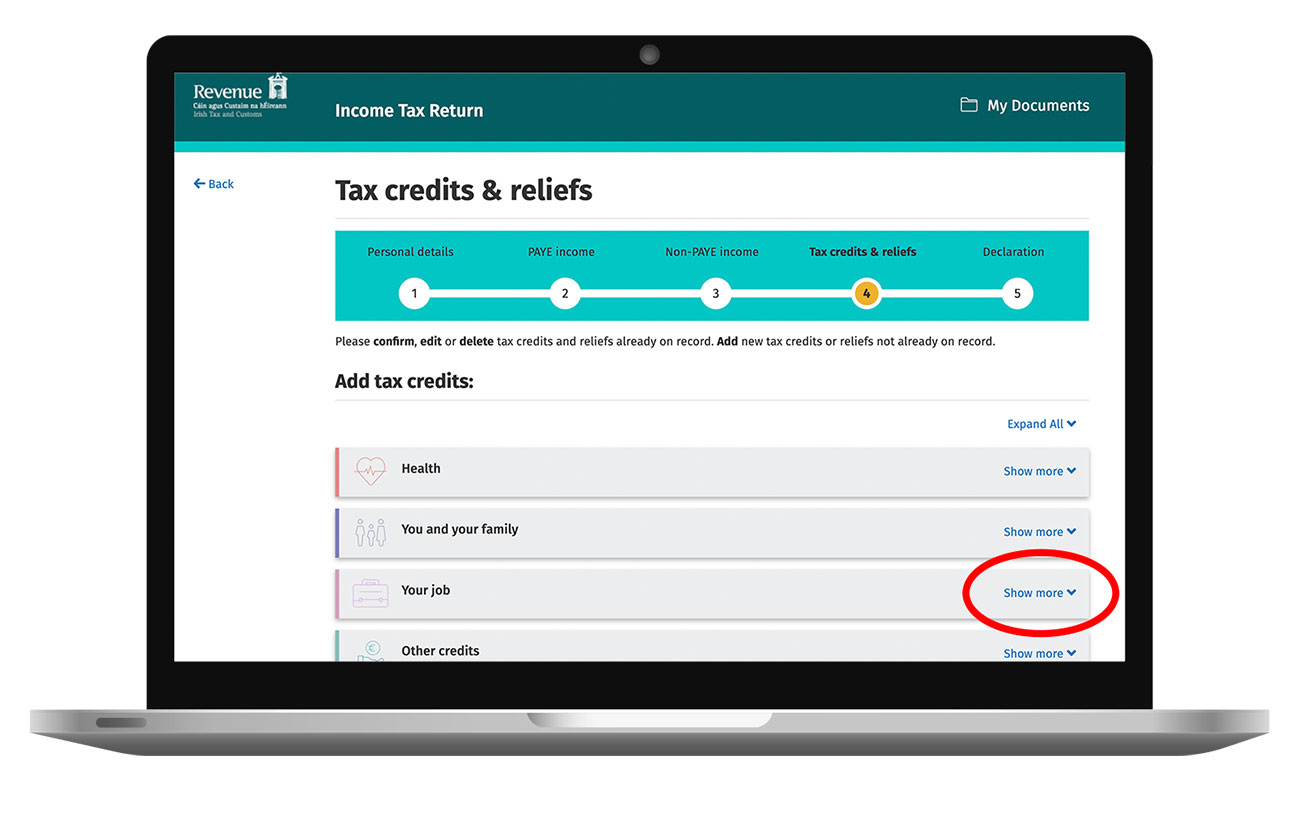

Step 10: Tax Credits and Reliefs

Select the “Show more” in the “Your Job” Section.

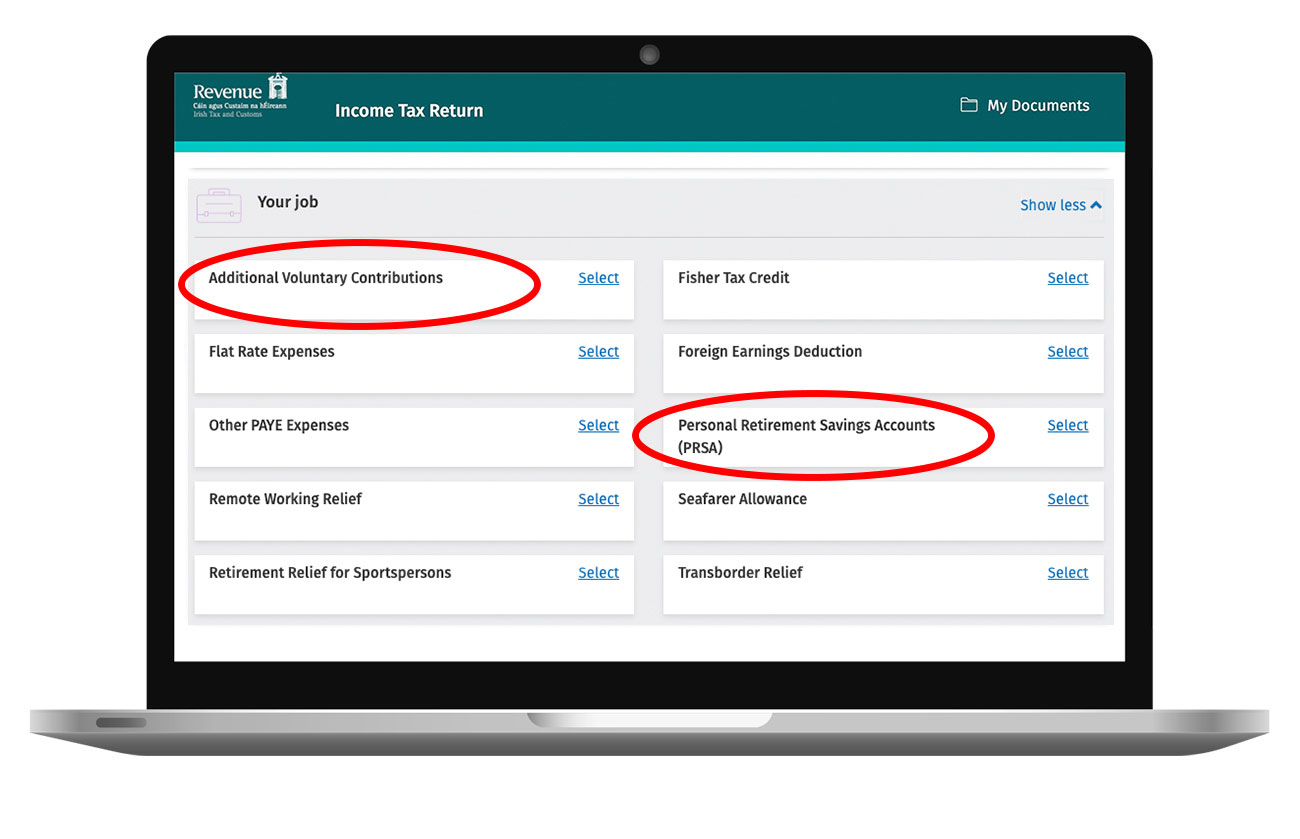

Step 11: Your Job

- Once clicked, a lit of different tax options will appear.

- Click “Select” in “Additional Voluntary Contributions” to proceed.

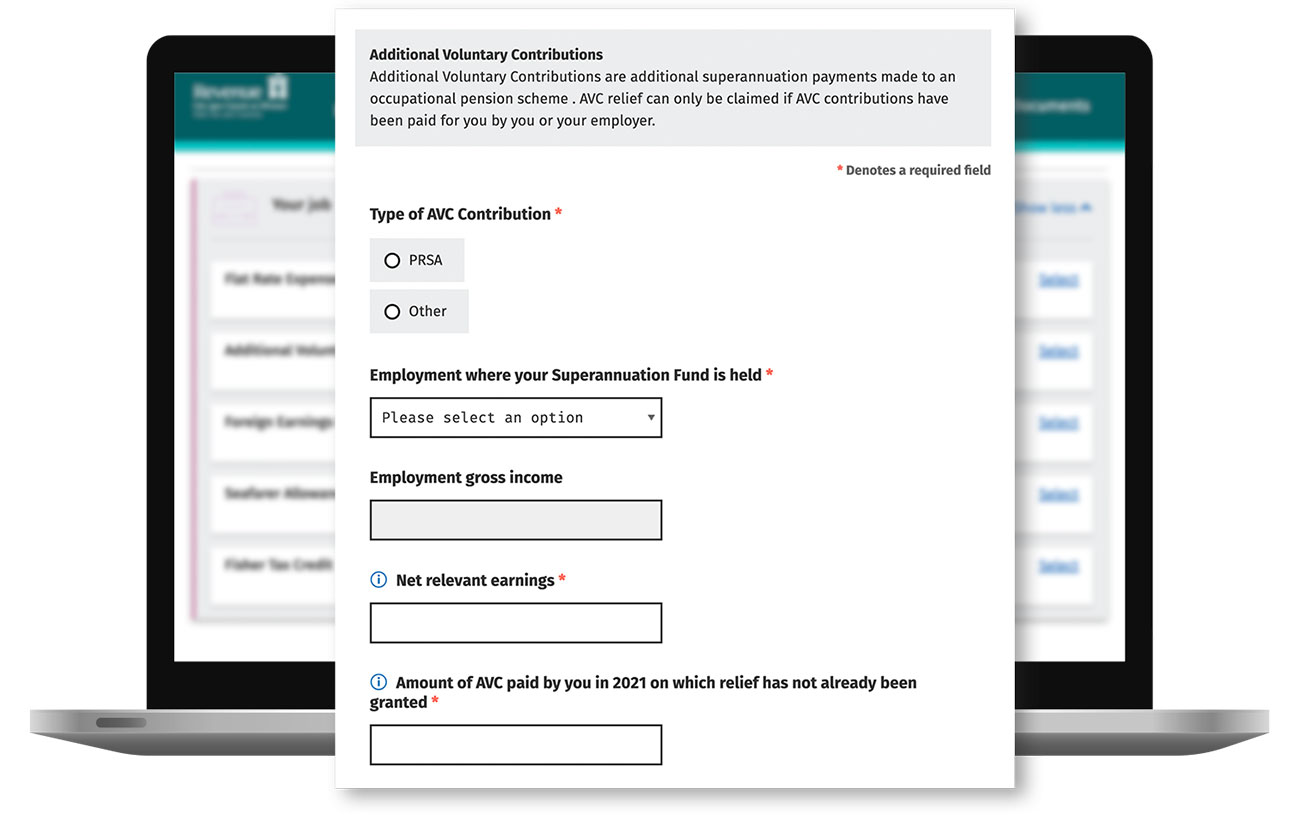

Step 12: AVC contribution

- Select the type of AVC Contribution you are looking for and enter your gross income and net relevant earnings.

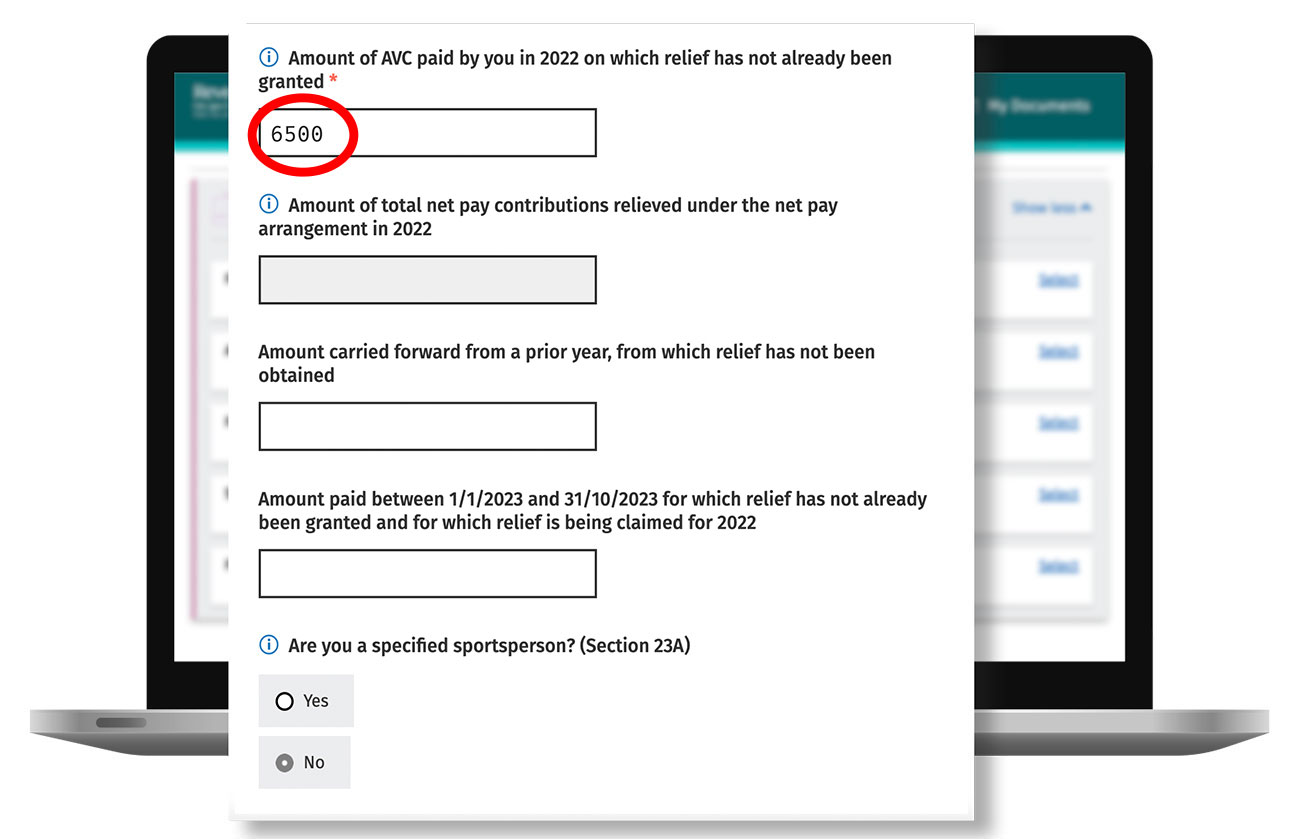

- Input the amount of AVC you are paying. In this

- example see €6,500 contribution.

- Fill in the remaining sections, which includes any additional AVCs or tax reliefs you may claim through the main pension scheme.

- This ensures you do not go over the age related limits.

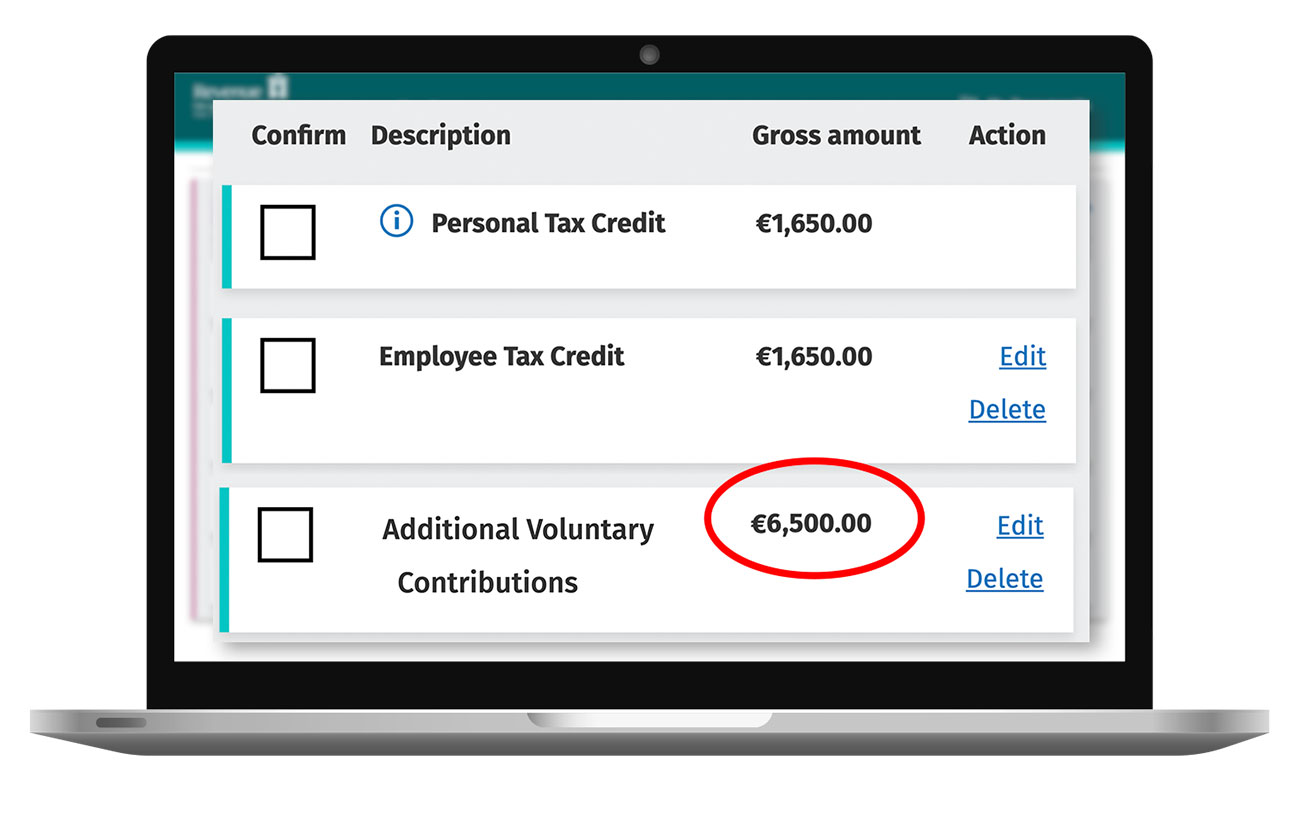

Step 13: Tax credits

- Once completed, your tax credits will be updated to include your lump sum Additional Voluntary Contribution.

- This is the amount of AVC paid by you in which relief has not already been granted.